Cost-Effective

Instant, easy solutions from anywhere. Apply with just one required document

Instant, easy solutions from anywhere. Apply with just one required document

Trust our direct lending with a new twist. Your data is secure, and we're there in difficult times

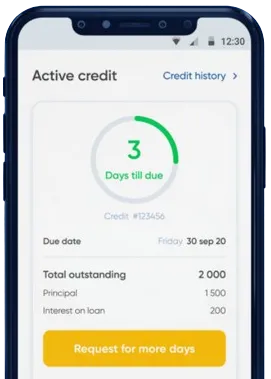

Straightforward solutions in just minutes from home. Money is transferred instantly; extend loans as needed

Use the app to send your request, simply fill in the form.

Stay tuned for a decision, usually ready in 15 minutes.

Have the money transferred to you, usually within one minute.

Use the app to send your request, simply fill in the form.

Download loan app

Personal loans are a type of unsecured loan that individuals can borrow from financial institutions to meet their personal financial needs. These loans are not backed by collateral and are based on the borrower's creditworthiness.

When it comes to personal loans in Nigeria, there are several options available for consumers. Banks, microfinance institutions, and online lending platforms offer personal loans with varying interest rates and repayment terms.

Personal loans offer several benefits to borrowers in Nigeria. One of the main advantages of personal loans is their flexibility. Borrowers can use the funds for a variety of purposes, including debt consolidation, home improvement, medical expenses, and education.

Moreover, personal loans in Nigeria can help borrowers build their credit history, especially if they make timely repayments. A good credit score can help individuals access better loan terms and other financial products in the future.

Personal loans can be a useful financial tool for individuals facing unexpected expenses or looking to achieve their financial goals. Whether it's covering emergency medical bills, funding a home renovation project, or financing a special occasion, personal loans can provide the necessary funds to meet these needs.

Furthermore, personal loans can help individuals avoid high-interest credit card debt by consolidating their debts into a single, manageable loan with a lower interest rate. This can help borrowers save money on interest payments and pay off their debts faster.

Before applying for a personal loan in Nigeria, borrowers should carefully consider their financial situation and needs. It's important to compare interest rates, fees, and repayment terms from different lenders to find the best loan option.

Personal loans in Nigeria can be a valuable financial tool for individuals looking to meet their personal financial needs. Whether it's funding a major purchase, consolidating debt, or covering unexpected expenses, personal loans offer flexibility, quick access to funds, and competitive interest rates. However, it's important for borrowers to carefully consider their financial situation and choose a reputable lender when applying for a personal loan.

A personal loan is a type of loan that is taken out by an individual for personal use. It is usually unsecured, meaning that it does not require any collateral.

Personal loans can be used for a variety of purposes, such as paying off debt, making a large purchase, home renovations, or covering unexpected expenses.

The amount you can borrow with a personal loan in Nigeria will vary depending on the lender and your creditworthiness. Typically, lenders offer personal loans ranging from ₦10,000 to ₦5,000,000.

Interest rates for personal loans in Nigeria can vary depending on the lender, your credit score, and the loan amount. On average, interest rates range from 5% to 30%.

To qualify for a personal loan in Nigeria, you typically need to have a steady source of income, be a Nigerian citizen or resident, have a valid ID, and meet the lender's minimum credit score requirements.

The time it takes to get approved for a personal loan in Nigeria can vary depending on the lender. Some lenders offer instant approval, while others may take a few days to process your application.